- By Crystal Hsu /

Staff reporter

Container shipper Wan Hai Lines Ltd (萬海航運) yesterday said it expects freight rates and business to remain healthy in the next few quarters, helped by rerouting needs and inventory building demand to dodge tariff hikes.

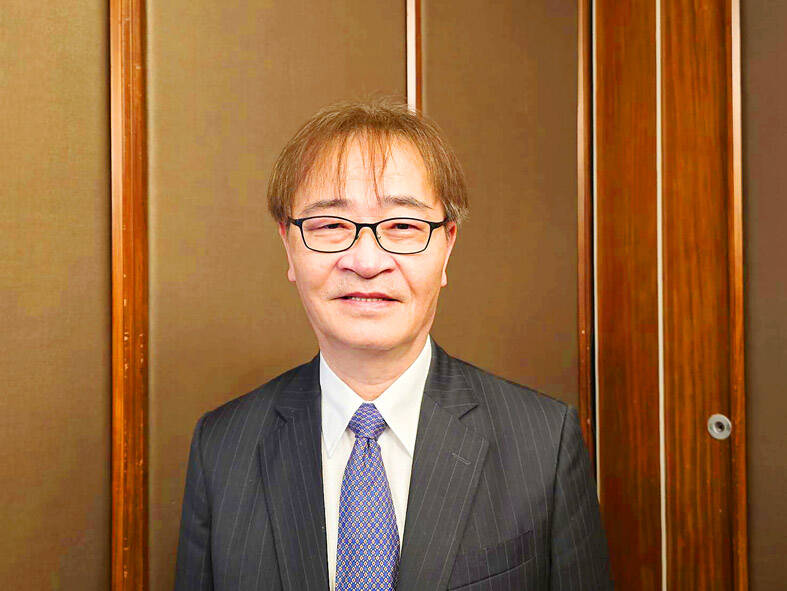

“We are positive about the business outlook in next six months and the second half of next year will depend on how the US trade policy pans out,” Wan Hai president Tommy Hsieh (謝福隆) said.

Hsieh attributed his optimism to lingering needs to divert vessels around Africa’s Cape of Good Hope since October last year to avoid attacks by Iran-aligned Houthi militants in the Red Sea.

Photo: CNA

The longer voyages have pushed freight rates higher, he said.

The disruption to container shipping traffic has reduced the industry’s capacity between the Far East and Europe by 20 percent, he said, adding that there appears no solution in sight to the Red Sea crisis.

Meanwhile, US president-elect Donald Trump has pledged to raise tariffs on goods from Canada, Mexico and China, a policy that could drive companies to build up inventory to circumvent higher costs later, Hsieh said, adding that such arrangements, seen during Trump’s first term from 2017 to 2021, would support freight rates.

Additionally, the chances of strikes by union dockworkers at ports on the US’ east and gulf coasts are escalating after Trump last week sided with the unions and expressed opposition to automation.

The Shanghai Containerized Freight Index, a critical business gauge for the industry, last week picked up 22.63 points, encouraged by Trump’s backing.

A strike would disrupt port operations and push up freight rates, Hsieh said.

A strike in October lasted only three days after the US government intervened.

Wan Hai’s earnings ability next quarter might be on par with this quarter, Hsieh said.

Port congestion would worsen next year, he said.

The average stay at Shanghai Port, the world’s largest, is three to four days, while it is three to five days at Singapore Port, Hsieh said, adding that Asian economies rely heavily on exports of raw materials and semi-finished goods.

A rise in the use of large vessels by shippers to save costs is also contributing to port congestion as docks are falling behind in processing efficiency, he said.

Furthermore, costs to charter cargo vessels this year have doubled from last year, reflecting tight supply, Hsieh said.

The backdrop would keep operating costs and freight rates high, he added.

Wan Hai runs ship and container rental businesses, shipping agencies, ship and container trading businesses, and port container terminal operations.

The company reported net income of NT$34.62 billion (US$1.07 billion) in the first three quarters of this year, or earnings per share of NT$6.57, reversing losses from the same period last year.

#Wan #Hai #expects #freight #rates #remain #healthy

Leave a Reply